alabama delinquent property tax phone number

Check out tax certificates liens deeds from select county auctions and the Alabama state inventory. Search Tax Delinquent Properties.

Property Tax Alabama Department Of Revenue

You can contact the Baldwin County Assessor for.

. And work with the sheriffs office to foreclose on properties with delinquent taxes. Below is a listing by county of tax delinquent properties currently in State inventory. For 2022 tax sales Calhoun.

To report a criminal tax violation please call 251 344-4737. Registration for Business Accounts. Sales Use Tax.

View How to Read County Transcript Instructions. Manufactured Homes - 3346774758. Alabama delinquent property tax excelsior college transcripts January 25 2022.

Wilcox County Assessor Phone Number 334 682-4625. Transcripts of Delinquent Property. Property taxes are due October 1 and are delinquent after December 31 of each year.

The median property tax in Wilcox County Alabama is 24600. The Baldwin County Assessor is responsible for appraising real estate and assessing a property tax on properties located in Baldwin County Alabama. To contact our office directly please call 205 325-5500 for the Birmingham Office or 205 481-4131 for the Bessemer Division.

Our vision is to assure the citizens of Alabama that compliance with the property tax laws rules and regulations is maintained in an efficient and effective manner. Additional information can be found in the Code of Alabama 1975 Title 40 Chapter 10 Sale of Land. When contacting Wilcox County about your property taxes make sure that you are contacting the correct office.

If you have any questions contact a Revenue Compliance Officer by calling 334 353-8096. Transcript of tax delinquent land available for sale 2753 mobile state of alabama-department of revenue-property tax divisionpage no1 date2252022. Parcel Fair brings you Alabama tax delinquent properties from over-the-counter state inventory sources plus local county tax sales.

Assessor Revenue Commissioner and Tax Sales Mobile County Revenue Commissioner 3925 Michael Blvd Mobile AL 36609 Phone. All taxable real and personal property with the exception of public utility property is assessed on the local level at the county courthouse with the county assessing official. And work with the sheriffs office to foreclose on properties with delinquent taxes.

Section 40-10-180 of the Code of Alabama declares the tax collecting official for each county shall have the sole authority to decide whether his or her county shall utilize the sale of a tax lien for the sale of. Property Tax Alabama Department Of Revenue. You can therefore refuse to pay any of the current local property taxes on your Alabama home so the county treasurer can sell a tax lien certificate to anyone willing to pay the current taxes.

Business Personal Property - 3346774757. 114 Court Street Grove Hill ALABAMA 36451. You may search for transcripts of properties currently available by County CS Number Parcel Number or by the persons name in which the property was assessed when it sold to the State.

Revenue Commissioner - 3346774747. Once you have found a property for which you want to apply select the CS Number link to generate an online. When using a social security number mask the number using the following format.

PUBLIC NOTICE TAX LIEN PUBLICATION. State laws allow the local government to sell homes as part of a tax sale process to collect delinquent taxes from home sales are legalized in all states. Ph 2512753376 Fx 2512753498 Example.

Search Mobile County property tax records by owner name address or parcel number and pay taxes online. You may contact the Revenue Commissioners Office to make sure your taxes are current. 334-242-1490 General Info or 1-866-576-6531 Paperless Filing Info Taxpayer Advocacy.

The transcripts are updated weekly. Baldwin County Assessor Phone Number 251 937-0245. NOTICE OF DECLARATION OF THE JEFFERSON COUNTY TAX COLLECTORS OFFICE TO TRANSITION TO TAX LIEN AUCTION.

Were busy loading county tax sale lists just in time for the 2022 auction season. Assessor Revenue Commissioner and Tax Sales Mobile County Revenue Commissioner 3925 Michael Blvd Mobile AL 36609 Phone. Search Mobile County property tax records by owner name address or parcel number and pay taxes online.

You should contact this office for information regarding additional exemption entitlements. Remember to have your propertys Tax ID Number or Parcel Number available when you call. Please call the assessors office in Marion before you send documents or if you need to schedule a meeting.

Alabama delinquent property tax phone number. 220 2nd avenue east room 105 oneonta al 35121. Checks or money orders should be made payable to the Alabama Department of Revenue.

40-10-122 on the minimum and the overbid see notes on bidding. Sales. To redeem the delinquent owner must tender the amount the purchaser paid to buy the Talladega County Alabama tax lien certificate plus any additional property tax the purchaser has paid up to the expiration of the 3 three year redemption period plus 12 per annum Sec.

Always write your assessment number and account number on the check. Intense tracer expert 1056 pm 1056 pm. Additional information on property tax exemptions are listed below.

Tax Delinquent Properties for Sale Search. If you have documents to send you can fax them to the Perry County assessors office at 334-683-2201. Once you have found a property for which you want to apply select the cs number link to generate an online application.

Property Tax Alabama Department Of Revenue

Late Paying Your Property Tax Investors See An Opportunity Wbhm 90 3

Tax Lien Properties Alabama Home Facebook

Tax Lien Properties Alabama Home Facebook

Greater Talladega Lincoln Chamber Of Commerce Alabama Tax Structure

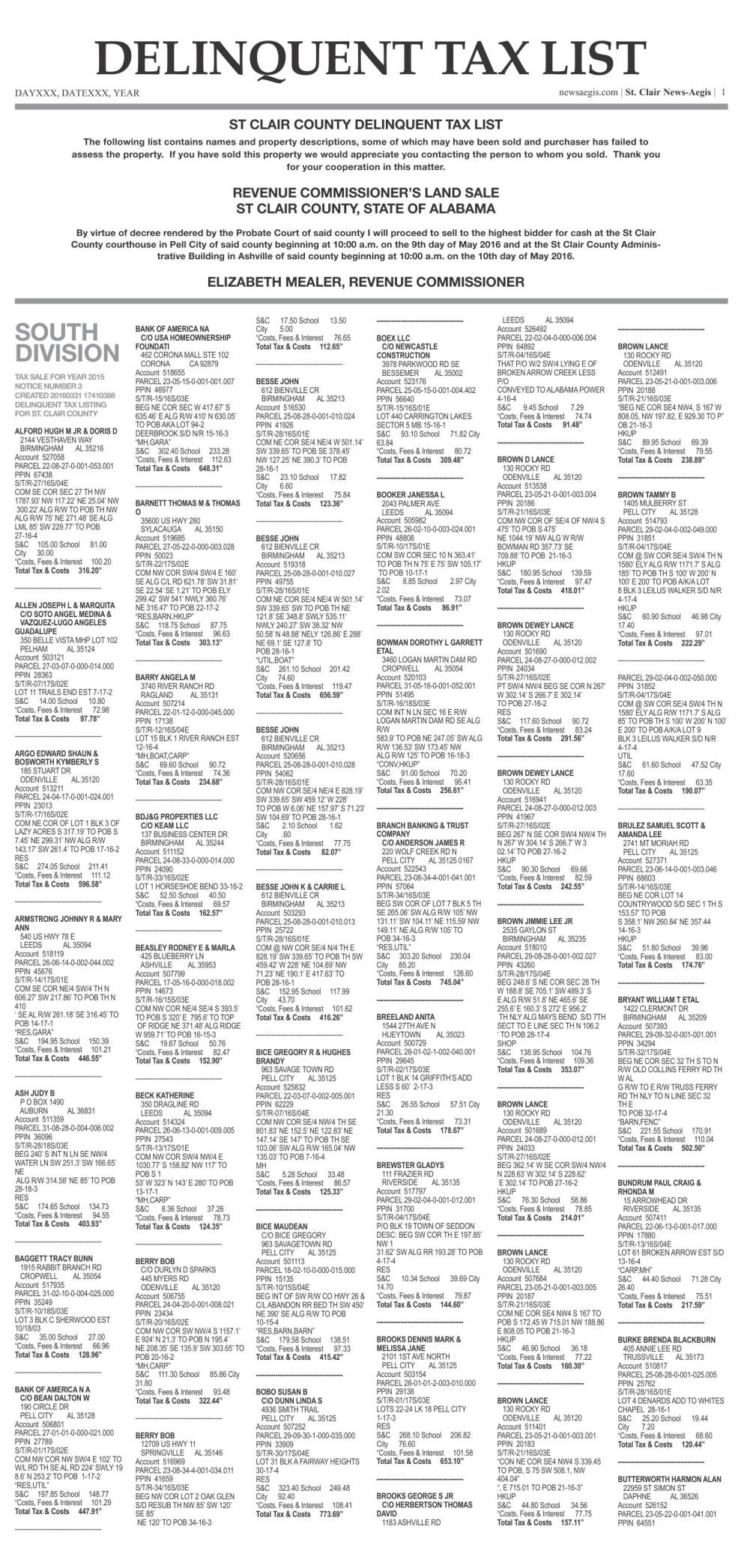

Delinquent Property Tax List St Clair County 2016 Newsaegis Com

Opelika Observer Lee County 2019 Delinquent Tax List By Opelikaobserver Issuu